Yes, you can borrow money from your parents to buy a house. There are two options to borrow money from your parents – you can either receive a gift or a loan. A gift and a loan are not the same when borrowing money to purchase a home.

While interest rates are on the rise, and the real estate market is cooling – home prices are still high in many places. With home prices remaining high, some might look to their parents for assistance when purchasing a home. The biggest factor that can hinder one’s ability to purchase a home would be the initial downpayment.

A conventional mortgage requires a 20% downpayment – and this would allow the buyer to avoid any mortgage insurance premiums. A cost saving of several thousand dollars. These savings are in addition to the thousands saved on interest costs by the remaining mortgage balance.

You can borrow money from your parents or relatives to purchase a new construction home or a pre-built home. When you are purchasing a new construction home, you need to understand when you start paying for a new construction home.

According to the Financial Post, an average of $82,000 is gifted by parents to their children to purchase a home.

When you are borrowing money from your parents to purchase a home, there are a few things to consider. Will this money be given to you in the form of a loan or a gift? Let’s have a look at the difference of receiving a gift and loan from your parents to purchase a home.

Table of Contents

Gifted Downpayment

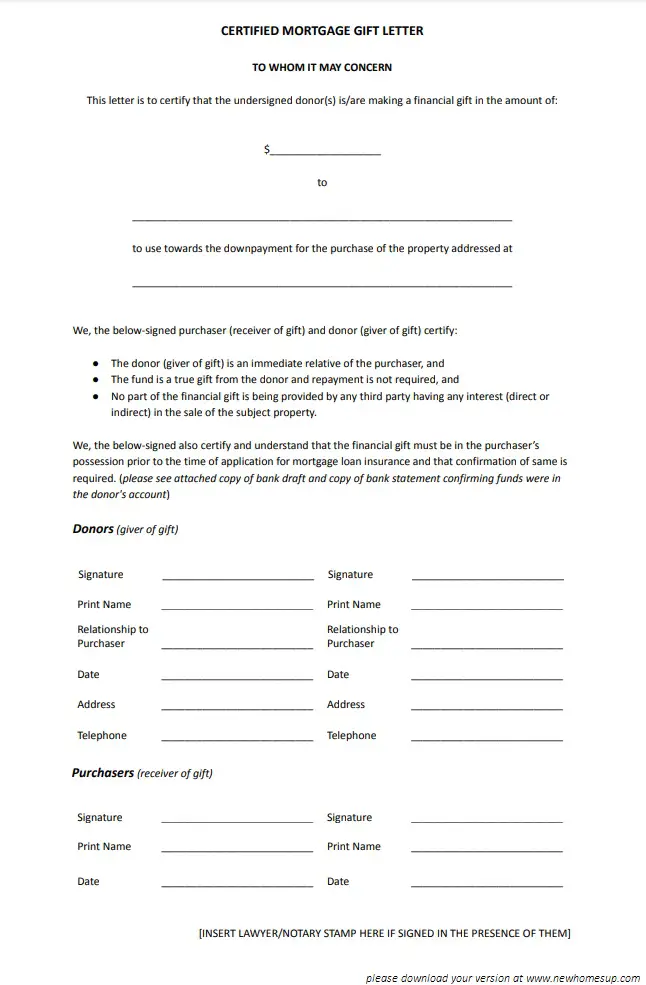

A gifted downpayment is exactly what you may think. It is gifted money to purchase a home, which is not expected to be paid back. Your mortgage lender needs to know that this gift is not expected to be repaid. Your parents will need to provide a letter certifying that the money they are giving you is a gift, and no repayment is required. This letter is called a mortgage gift letter.

You can download this sample mortgage gift letter in PDF and complete it, and submit it to your mortgage lender.

Mortgage Gift Letter Should Include:

- The value of the gifted money and currency

- The name(s), address, and contact information of the gift receiver

- The name(s), address, and contact information of the gift donor

- The relationship between the donor and receiver

- The date of the gift

- The address of the new property being purchased

- A statement certifying the money is a gift

So, who can gift you the money for a downpayment? A few lenders will have rules on who may gift you the money to purchase a home – such as parents only. In most cases, the gifter should be a relative such as a grandparent, aunt, uncle, sibling, or other close relatives.

Some lenders will request your gifter to show proof that the money they are gifting you came from their own account. This proof may be a three-month bank account statement. This is important, as you cannot receive money from another source – and ask your relative to gift it to you.

Loaned Downpayment

A loaned downpayment is money that you receive as a loan, where repayment is required. Since this loan is meant to be repaid, it will be taken into consideration when your mortgage qualifications are being reviewed. In essence, the monthly payments you would make to pay the loaned downpayment will be considered a monthly debt, and will be included in your debt-to-income ratio.

The loaned downpayment can be setup as a lien on the property as well, so that your parents maintain some control over the home. You can setup payment terms – regardless of whether this loan will accrue interest charges or not.

This would only be a good option, if you have a very low debt-to-income ratio, and you have a high enough income to cover your debts.

You can receive as much money as you want as a gifted downpayment. However, in most cases – this is generally 20%. There is also no tax on the gifted downpayment, so it is a win-win situation for both sides.

If the home buyer is not someone who receives a T4, such as a self-employed business person – the mortgage lender may require the buyer to put up a minimal downpayment (usually 5%).

While you can borrow money from your parents to buy a home – there is no guarantee that their assistance can help you complete the home purchase. It is important to understand the entire mortgage application process.

The money you receive from your parents to buy a home will help with the first part of the mortgage requirement – the downpayment. There is an underwriting process that will identify if you can afford to make the monthly payments – including other home expenses. These other expenses include maintenance fees, water, utilities, and property taxes. You will also have costs such as closing costs, lawyer fees and the cost of moving and furnishing your home. If your income is not enough to qualify for the mortgage – you can still get denied. You can see our post on reasons why mortgage applications get denied.

What Happens If You Pay Back a Gifted Downpayment

A gifted downpayment is a gift, and it was certified as such by the mortgage gift letter you provided to your mortgage lender. This letter certifies that the gift is not to be repaid, and there are no repayment requirements. In some cases, the mortgage gift letter is considered a binding agreement, and going against it can be considered mortgage fraud.

Instead of paying back your mortgage gift, you can do something in return for your parents. Since your parents helped you get into your first home, you might be urging to help them out. You could return the favor by giving them money to get settled in a new retirement community – or have them move in with you. There are many ways you can pay back for the gifted downpayment, without explicitly paying back your mortgage gift. After all, a gift is a gift – and there are no strings attached to it.

Risks of Signing a Mortgage Gift Letter

There are no risks in signing a mortgage gift letter, because you are not liable for any mortgage payments, taxes or liens. A mortgage gift letter simply states that you are providing a gift in the form of money, and there is no repayment required. It can only become a risk if you are providing wrong information on the letter, such as stating the money is a gift when it is actually a loan.

In today’s digital world, some lenders may accept an electronically signed mortgage gift letter – but this is something you might want to confirm with your mortgage broker. All banks and lenders have their own set of rules when it comes to accepting signed documentation. It is always safe to sign a mortgage gift letter with your wet signature. It is easily verifiable with other documents you may have submitted.

To add more substance and legality to your mortgage gift letter; you can sign the gift letter in the presence of a lawyer, commissioner of oath or notary public.