A bank can verify a check and know it’s good by calling the payer bank and providing them with the name of the payer, home transit number and account number. The payer bank will check the account to see if there is sufficient funds in the account to be debited. If the payer bank is the same bank, the verification can be completed in-house.

When depositing a cheque/check at a bank, most banks will want to verify your deposits – especially if you have no history of making deposits. For example, if you never make large deposits and suddenly, you have a $6,000 deposit – the bank will verify this check.

In this case, there are two possible scenarios:

- The deposit funds are coming from another financial institution

- The deposit funds are already held at your financial institution

The approach is different in both cases, and can delay the availability of funds in your account.

Table of Contents

Written Check is from Another Bank

If the check you are depositing is from another financial institution or bank, your bank may want to verify if the check is good. They can do this by calling the other bank and providing them with the name of the person/company that is paying you, along with their account number and home transit number.

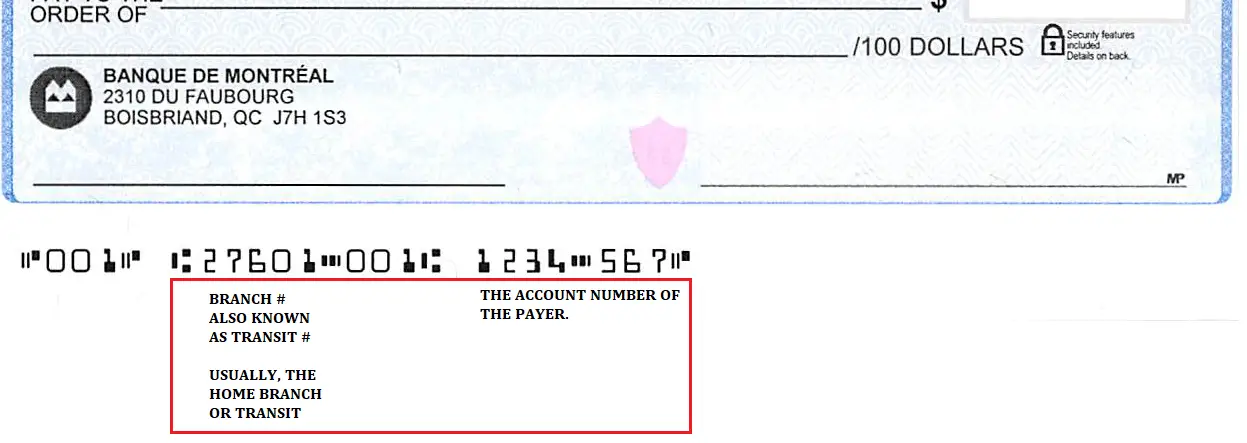

This information is the micro-encoding found on the bottom of the cheque.

The other bank will then check the account to see if the funds are available in that account. Keep in mind, that the balance in the other account needs to be free of any holds. If there are holds on the balance, your check will not get deposited successfully.

A good check verification ensures the following:

- The payer has owned the bank account for longer than 1-3 months

- The payer did not make another check deposit to cover this deposit

- The payer has a good history of honoring written cheques

- The payer is in good standing with their bank

- The payer’s signature matches their documentation

- The check amount written in words and numbers matches

- The currency of the check is verified (ie: USD or CAD)

- The check is not stale dated (older than 6 months)

- The check is not materially altered or changed

Once a bank has confirmed all of the above, they will confidently deposit a check without any holds. In general, some banks will place a 5 day hold on deposits. If the hold needs to be removed, you can request for it from the branch manager. A branch manager at most banks will have authorization to remove a hold on a check.

How Long Does it Take for a Bank to Know if a Check is Good

In most cases, if the other bank answers their phone on the first call – it should take less than an hour to confirm if a check is good. If the other bank is busy, they may request a call back to confirm and verify the check.

Written Check is from Your Bank

If the written cheque you are depositing is from your bank, it’s much easier to verify the check. Your branch will simply look up the account for the person who is paying you. If the account has the necessary funds, and there are no holds on their account – you will be in the clear.

However, your branch will still go through the check verification checklist to ensure that it meets all the verification requirements.

Today, there are far too many situations where companies and personal account holders deposit fraudulent checks. Banks are becoming more and more vigilant, as they should.

As someone who is making the check deposit, you need to be aware of who is paying you. It is not recommended that you accept a check from an unknown person.

Best Check Verification for Depositors

There are two ways you can be confident when depositing a check. First, you can ask the payer to go to their bank and have it certified. A certified check is a regular written check that has been verified and certified by their bank.

The certified check ensures that the accepting bank will make the deposit without any issues. There may be a charge to get a check verified and certified, but it is worth not having to go through any hassle.

Second, you could ask the payer to provide you with a bank draft. A bank draft is a certified financial instrument that contains funds on it, which has been verified by the bank.

When a payer creates a bank draft, the funds have actually left their account and placed on the bank draft. It is a safe way to ensure that you receive the funds that are owed to you. In Canada, most banks will charge a $7.50 fee to create a bank draft. Every bank draft will have a serial number unique to the draft.

In the event, the bank draft is lost or stolen, it is good practice to always keep note of the following:

- The branch where the bank draft was purchased

- The date of purchase

- The amount of the bank draft and currency

- The serial number of the bank draft

- The payee the draft was made out to

If you have this information, it will be easy to request a replacement bank draft from the bank.

With a certified cheque or bank draft, you no longer have to worry about how does a bank know if a check is good.

What Happens When You Deposit a Fake Check?

If you deposit a fake check, you can be held legally liable and face Federal fines and jail time. A fake check is one that has been materially altered or changed. These counterfeit items are caught by banks and will get charged back on your account.

When a banking customer deposits a stale dated check, counterfeit item or materially altered check – it may get deposited, and they may see the balance increase in their account. In some cases, they’re able to use those funds right away.

However, once the bank catches the item, they will complete a chargeback on the cheque. When a check is returned or charged back, the account will be debited for that amount. Even if there are no funds in the account, the bank will collect from the customer, forcing an overdraft position.

The owner of the account will be asked to provide funds to cover the negative balance position in the account or face account closure. If the account holder has other accounts with funds, the bank may be able to collect from those accounts as well.

Today, financial institutions have many systems in place to catch forgery and fraud – it may not happen on the day it’s committed, but they will catch it. It’s always advised to be honest with a bank, because they’re doing so much to look after your money.